Türkiye’den Global Bir

Perspektifle 35 Yıl

YAZICI

Avukatlık Ortaklığı

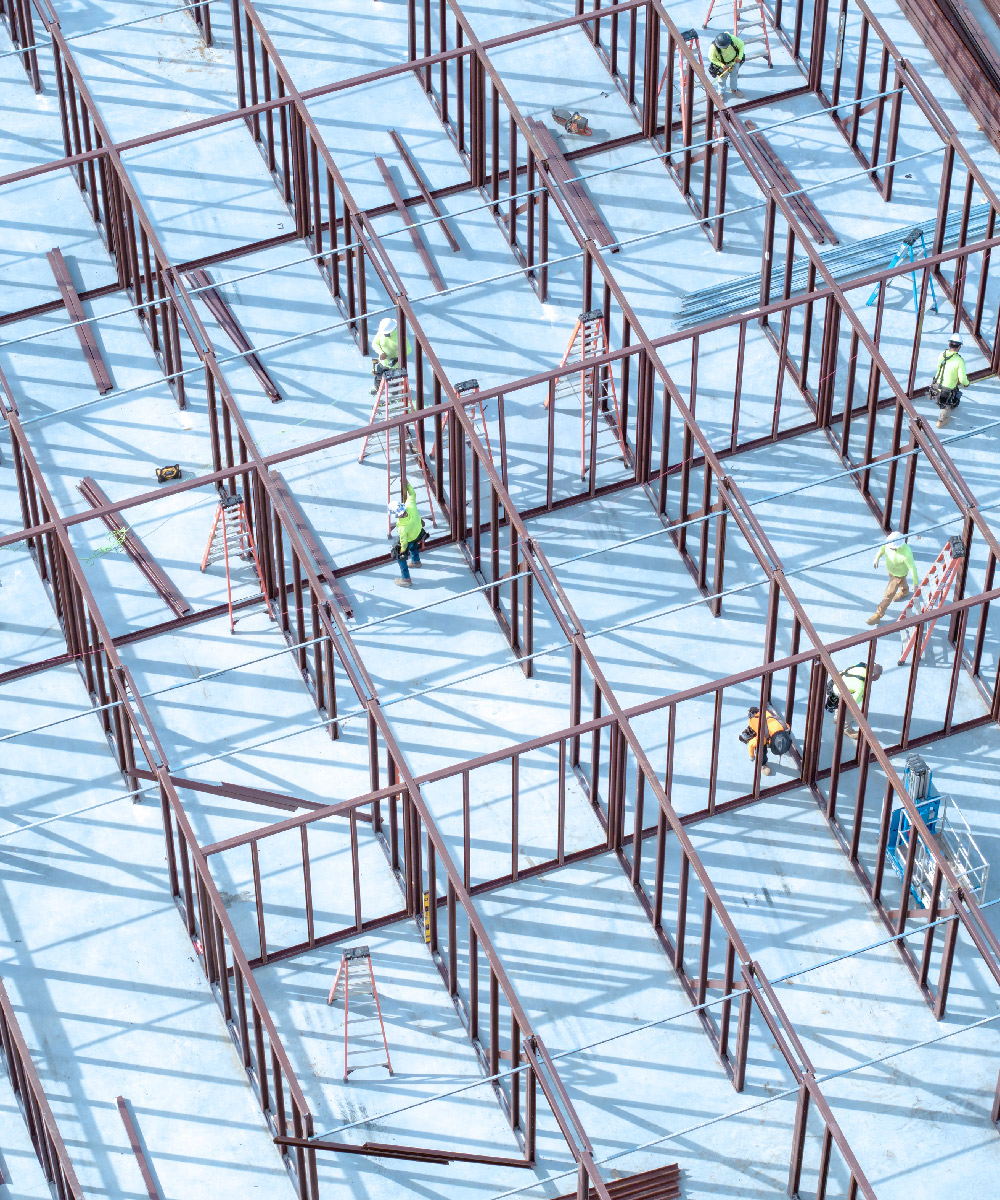

En yüksek kalitede hukuki hizmet sağlama azmimizin uluslararası alandaki tecrübemizle birleşimi sayesinde karmaşık ve zorlu işlem ve uyuşmazlıklarda çalışma imkânı bulmaktayız. Önceliğimiz, müvekkillerimizle güçlü ilişkiler inşa ederek onların güvenini kazanmak, bu güveni korumak ve üstün sonuçlar elde etmektir.

Faaliyet

Alanlarımız

Geniş bir yelpazede hukuki hizmet sunarak bireysel ve kurumsal müvekkillerimizin her türlü hukuki ihtiyacına çözüm üretmek için mutlulukla çalışıyoruz. Uzman kadromuzla hem yerel hem de uluslararası arenada, dinamik ve titiz bir yaklaşımla faaliyet gösteriyoruz.

Her zaman hukukun farklı dallarını kapsayarak müvekkillerimizin karşılaşabileceği karmaşık sorunlarda etkin çözümler sunmayı hedefliyoruz.

Profesyonel, etik ve sonuç odaklı hizmet anlayışımızla; hukuki süreçlerinizi güvenle yönetmek için yanınızdayız.

Kariyer

Yeni mezun veya konusunda deneyimli, ileri düzeyde İngilizce bilen, yüksek tempoda çalışabilecek avukatların başvurularını değerlendirmekte ve kariyer gelişimlerini desteklemekteyiz.

HER AŞAMADA YANINIZDAYIZ!

Uzman ekibimizle hukuki süreçlerinizi baştan sona ele alıyor,

sizin için en etkili çözümleri sunuyoruz.