KEREM ARIÇ

February 2020

Notable Developments in Turkey’s Energy Policy

I. Introduction

Due to its dependence on oil and natural gas imports, Turkey has been in need of structural changes in its energy sector. Although the share of natural gas in power generation was significantly reduced in 2019, the overall reliance on natural gas and oil imports creates major challenges both from a commercial and strategic perspective. To overcome these challenges and increase its energy security, the Turkish Government moved over the past years from a role of investor to a role of policy maker and market regulator.

As of November 2019:

- Turkey imported approximately 62% of its oil needs from three countries, namely Russia (%34.65), Iraq (%20.05) and Kazakhstan (%7.34).

- Turkey imported approximately %74 of its natural gas needs again mainly from three countries, being Russia (%33.92), Azerbaijan (%22.81) and Iran (%17.32).

Hence the reduction of oil and natural gas imports for Turkey are as important as the diversification of resources since we see that it is currently highly dependent on a couple of countries regarding its energy needs, especially on Russia for both oil and natural gas.

This article aims to discuss notable developments in Turkey’s energy policy through an analysis of the following topics:

- Development of Oil and Natural Gas Pipelines

- Potential New Natural Gas Import Resources

- Development of LNG receiving terminals, FSRU and storage capacity

- Security and Sustainability of Power Generation

II. Development of Oil and Natural Gas Pipelines

A. Natural Gas Pipelines

There are no plans to expand, in the foreseeable future, the capacity of Blue Stream, the Iran–Turkey pipeline and the Baku–Tbilisi–Erzurum (BTE) pipeline. Hence Turkey’s energy policy aims to increase its import and transit capacity with two projects: TANAP and TurkStream.

With the completion of TANAP and TurkStream, Turkey becomes an important natural gas route from Azerbaijan and Russia to Europe and will almost double the total transit capacity of the country. Both new pipelines will contribute to Turkey’s supply security and allow BOTAŞ to receive and help mitigate demand surges related to seasonality. Out of TANAP’s total capacity of 16 billion cubic meter (bcm) of natural gas, it is expected that 6 billion will be used for Turkey’s internal consumption needs, while 10 billion bcm will transit to Europe via the Trans Adricatic Pipeline (TAP). Depending on the demand, the project partners expressed their intention to increase TANAP’s capacity to 31 bcm. Given the fact that it is the largest section of the Southern Gas Corridor connecting the Shah Deniz through the Trans Adriatic Pipeline to Italy, TANAP’s capacity increase will without doubt have a significant impact for Europe’s natural gas security as well as creating new export opportunities for Azerbaijan. The project is also important to satisfy the Turkish government’s energy policy of diversification of supply sources, increase of import volumes into the country, and re-export of surplus gas. In that sense, the project will likely support the government to increase its political weight with the countries to which it will export natural gas.

With a capacity of 31.5 bcm, TurkStream is important to Turkey for two reasons: (i) to enhance supply security by eliminating a transit country such as Ukraine (which is one of the transiting countries of the West Line) and hence enabling a direct line between Turkey and Russia in addition to the Blue Stream pipeline, and (ii) to strengthen its position as a transit country for gas exporting and the EU. The offshore component of the system consists of two parallel pipelines running through the Black Sea. The pipelines enter the water near Anapa, on the Russian coast, and come ashore on the Turkish coast in the Thrace region, near the town of Kiyikoy. From the receiving terminal in Kıyıköy, one of the two underground onshore pipelines will connect to BOTAŞ’ gas network at Lüleburgaz and the other pipeline will continue to the Turkish-European border. Hence the first string of the pipeline is intended for Turkish consumers, while the second one will deliver gas to southern and south-eastern Europe.

Obviously, TurkStream does not serve Turkey’s objective to reduce its dependence on Russian gas and the government will aim to replace natural gas imports from Russia with less expensive alternatives. However, Turkey could increase the interdependence between the two countries on natural gas imports/exports, to cause Russia to be dependent on Turkey as a transit country for gas transit to the Balkans and southeast Europe. Hence Turkey may benefit from the TurkStream project provided that it makes good use of its negotiating power with Russia with the aim of getting the upper hand strategically in the long-run, rather than short-term benefits such as a price discount.

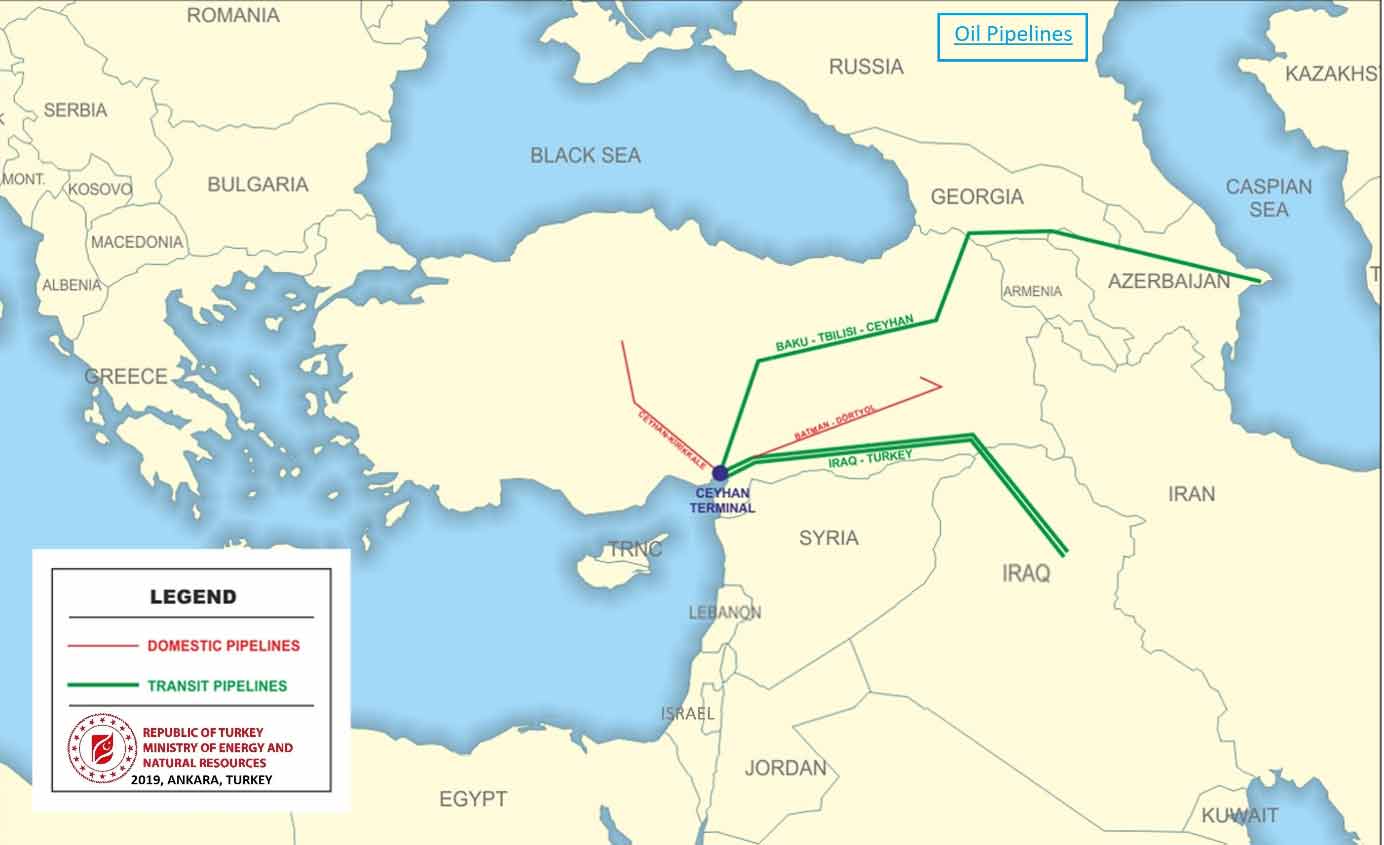

B. Oil Pipelines

Announced earlier this year, Turkey and Iraq plan to build a new pipeline to transport Iraqi crude oil from the oilfield of Kirkuk to the Turkish port of Ceyhan alongside the existing track. The construction of a new pipeline running parallel to the existing Iraq-Turkey crude oil pipeline is expected to increase oil trade through the port of Ceyhan. The Iraq-Turkey Crude Oil pipeline was initially constructed to carry Kirkuk oil to global markets through the Ceyhan terminal, with a total capacity of 1.2 million barrels of oil per day. However the Iraqi part of the pipeline has been damaged due to Daesh attacks over time.

It is expected that construction of the new pipeline will take two to three years to complete, taking into account security and financing issues. From a security perspective, the fact that the planned pipeline will be linked to the central Iraqi oil pipeline system as before, shows that Iraq favors Turkey as a second exit door after Basra for its oil exports, since the project will allow Iraq to transport oil produced in its southern fields.

The current status of domestic and import oil pipelines in Turkey can be seen in the map below:

According to the data from the Energy Market Regulatory Authority, the distribution of oil imports by countries as of November 2019 was as follows:

| IMPORT COUNTRY | (%) |

| Russian Federation | 34.65 |

| Iraq | 20.05 |

| Kazakhstan | 7.34 |

| India | 6.94 |

| Iran | 5.43 |

| Nigeria | 4.55 |

| Saudi Arabia | 4.37 |

| Libya | 2.40 |

III. Potential New Natural Gas Import Resources

There are two potential alternative sources of natural gas supply to Turkey – Iraq and the East Mediterranean region. However, supplies from countries are distressed with political, geopolitical and financial difficulties; hence their realization seems to be remote.

The Kurdistan Regional Government is geographically a strong option for new natural gas supply to Turkey. However, the main obstacle lies in security issues and companies operating in northern Iraq need more resources to fund security due to the increase of refugees fleeing from Syria and terrorist attacks within the country itself. Furthermore, the recent pro-independence referendum in the Kurdistan Region of Iraq (KRI) escalated the tensions with Turkey, which tensions may delay any gas project developments in the KRI itself. Therefore, it appears that natural gas imports from the KRI to Turkey in the short term are not likely.

Israel and Cyprus are potential natural gas producers in the eastern Mediterranean with potential exports of 12 to 16 billion cubic meters through offshore pipelines, although proven reserves are much lower. However, the estimated cost of the project including field development expenses will make the project very difficult to be commercially feasible. Since the transportation of East Mediterranean gas through Greece and Italy is even more costly due to the longer distance of the offshore pipeline, this makes the realization of the project difficult for the time being.

From a Turkish view, possible gas deliveries from East Mediterranean to Turkey would serve Turkey’s aim to diversify its natural gas import sources and store these in storage facilities. This would of course put Turkey in the middle of the regional natural gas network and increase its political leverage vis-à-vis both Russia and Europe. Turkey therefore aimed to develop upstream activities in the East Mediterranean, which offers a potential for natural gas supplies to Turkey. Through its national oil company Turkish Petroleum Corporation (TPAO), Turkey recently acquired two offshore drillships to carry drilling activities on its own along the Turkish coast and off the coast of Cyprus. TPAO drilled four deep sea wells and three shallow sea wells this year and the Turkish Government is to conduct five offshore drilling rounds in 2020, especially for shale and methane gas exploration.

IV. Development of LNG receiving terminals, FSRU and storage capacity

A. LNG Terminals and FSRU’s

With the aim of improving its energy security, Turkey is also increasing its capacity at existing LNG receiving terminals and building new Floating Storage and Regasification Units (FSRUs), since this allows greater flexibility in importing and storing natural gas. The aim is also to provide an advantage to gas importing companies to meet growing demand in winter instead and avoid to increase annual purchase quantities under pipeline contract quantities (ACQ) due to the application of “take or pay” clauses. By increasing LNG terminal capacity, Turkey will also be able to increase spot LNG imports when needed.

Currently, Turkey operates four LNG terminals two of them are floating storage and regasification units (FSRU) and the remaining two are land facilities. The LNG terminal in Marmara Ereğlisi, located 120 km west of Istanbul in the northern Marmara Sea, currently operates with a capacity of 5.9 million tons. The terminal is capable of sending out 8 billion cubic meters of gas annually. Another land terminal is located in the industrial Aliağa district of the Aegean province of İzmir with a capacity of 4.4 million tons of LNG. The İzmir terminal has a regasification and compression capacity for 6 billion cubic meters per year.

In 2019, a new FSRU was put into operation in Aliağa-İzmir. The new facility has a storage capacity of 170,000 cubic meters of gas and has a gasification capacity of 28 million cubic meters of natural gas per day. The new facility will add both storage and compressing capacity to the existing FSRU’s in Turkey, the main one being operated by BOTAŞ at Hatay’s Dörtyol district, which has a gasification capacity of 20 million cubic meters of gas per day and store of 263,000 cubic meters. In addition to the current facilities, BOTAŞ is developing a fifth FSRU to be located in the Saros Bay.

It is expected that the current and planned facilities will allow an increase of LNG imports and reduce Turkey’s dependence on pipeline gas imports in the medium term.

B. Storage Facilities

The Turkish government is planning to more than triple Turkey’s underground storage capacity at its two facilities at North Marmara-Değirmenköy in Silivri and Tuzgölü from the current 3.4 bcm to 10 bcm by 2023.

Gas storage in Turkey is crucial for the following reasons:

i) to deal with seasonal balancing and potential supply shortages; and

ii) to store extra gas when prices are low and sell the same demand increases.

With the expansion project of the Tuzgölü natural gas storage facility, its capacity will be increased to 5.4 billion cubic meters by 2023.

V. Security and Sustainability of Power Generation

As of the end of the first half of 2019, 15.2% of Turkey’s electricity production was obtained from natural gas, 33.2% from coal, 36.6% from hydropower, 7.2% from wind, 3.0% from geothermal, 3% from solar energy and 1.7% from other sources. While the decrease of electricity production through natural gas is substantial, we can see that it has been largely replaced by coal which is as we know a polluting source. Hence Turkey’s strategy to ensure sustainability in power generation goes without a doubt shall be driven by the development of renewable energy sources. According to the International Energy Agency, Turkey is on its way to being among Europe’s five biggest renewable energy countries, with a 50% renewable energy installed capacity growth set to reach 63 gigawatts (GW) by 2024. Turkey had 42 GW of installed renewable power at the end of 2018, and this figure is set to increase by 50% between 2019 and 2024 to reach around 63 GW by 2024. This capacity could make Turkey one of the five countries in Europe with the highest renewable-based capacity.

The distribution of electricity generation in Turkey by sources between 2010 and 2019 can be seen in the below table:

| YEAR | NATURAL GAS | HYDRAULIC | COAL + LIGNITE | WIND | GEOTHERMAL |

| 2010 | 49.74 | 16.77 | 29.09 | – | – |

| 2011 | 44.7 | 22.8 | 26.9 | 2.1 | – |

| 2012 | 44.5 | 23.6 | 26.6 | 2.9 | 0.28 |

| 2013 | 43.8 | 24.7 | 26.3 | 3.1 | 0.6 |

| 2014 | 47.9 | 16.1 | 29.9 | 3.4 | 0.9 |

| 2015 | 37.81 | 25.76 | 28.05 | 4.45 | 1.30 |

| 2016 | 32.16 | 24.7 | 33.92 | 5.69 | 1.77 |

| 2017 | 37.18 | 19.96 | 33.85 | 6.10 | 2.04 |

| 2018 | 30.88 | 20.28 | 38.37 | 6.73 | 2.58 |

| 2019 (Nov.) | 18.56 | 23.13 | 38.18 | 7.35 | 3.03 |

We can see that the share of natural gas in electricity generation was considerably reduced over the last decade, while the share of renewable resources progressively increased. However, the decrease of the share of natural gas in electricity production has been more driven by cost reasons (generation costs being too high due to the price of natural gas in Turkey), than environmental considerations as can been from the increased consumption of coal and lignite.

A. Geothermal Energy

Turkey has approximately 1,000 geothermal springs that are located all over the country. The installed capacity of geothermal energy as of 2018 was 14.9 GWe. Turkey is among the top five countries in the world in terms of geothermal power generation capacity. Considering that 78% of potential geothermal fields are situated in Western Anatolia, Turkey has an important prospect in the developing geothermal power generation capacity in that region.

B. Wind Energy

The wind energy potential of Turkey has been estimated as 48,000 MW. However a recent study of the World Bank shows that Turkey has nearly 70 gigawatts (GW) of technical potential for offshore wind energy. A fixed offshore wind farm means that wind turbines sit on a stable base, but this configuration is only suitable in waters up to 50 meters deep. However, floating offshore wind farms are tied to the seabed for stability and to reduce drift. These wind farms allow additional wind power generation at water depths exceeding 50 meters. The World Bank’s report mentions that “The Sea of Marmara and the Black Sea have good wind speeds of 7–8 m/s. There are many pockets of opportunity along the western coast and to the southeast”. Areas with water depths of less than 50 meters have the technical potential to generate a total of 12 GW and in waters of 1,000 meters depth, a further 57 GW, according to the report.

The World Bank said that as transmission networks to demand centers in the north and west are quite strong with 380 kilovolt (kV) and 154 kV lines, reinforcement will be needed to accommodate offshore wind, especially for projects of more than 1 GW.

C. Hydroelectric and Solar Energy

Turkey’s hydraulic resources, which hold the most important position in the renewable energy potential of our country, possess a hydroelectricity potential of 433 billion kWh, while the technically usable potential is 216 kWh, and the economic hydroelectricity potential is 140 billion kWh/year. According to the IEA, Turkey’s hydroelectric capacity will reach 31 GW in 2024 with an 11% growth rate compared to the 28 GW of installed capacity at the end of 2018. With respect to solar energy, it is expected that Turkey will add 10 GW of solar capacity by 2024 out of which 3.7 GW will derive from rooftop systems. As a result, solar power is expected to increase by 198% between 2019 and 2024.

D. Incentive Mechanisms

For the development of renewable energy resources in Turkey, it is also vital to determine the future of incentive mechanisms such as the current YEKDEM mechanism which is a renewable energy support system which will stop operating at the end of the year 2020. This means that power plants to be commissioned after that date, will sell to the free market without a guaranteed price. As of today, it is still unclear if there will be incentive mechanism to replace YEKDEM and if so when it will be implemented. Long-term sectors investments through YEKA (allocation of large publicly owned land for the plantation of power plants) can be an alternative. However, the significance of a guaranteed purchase shall not be undervalued since it has played a central role in the financing of renewable energy projects in Turkey for the past ten years.